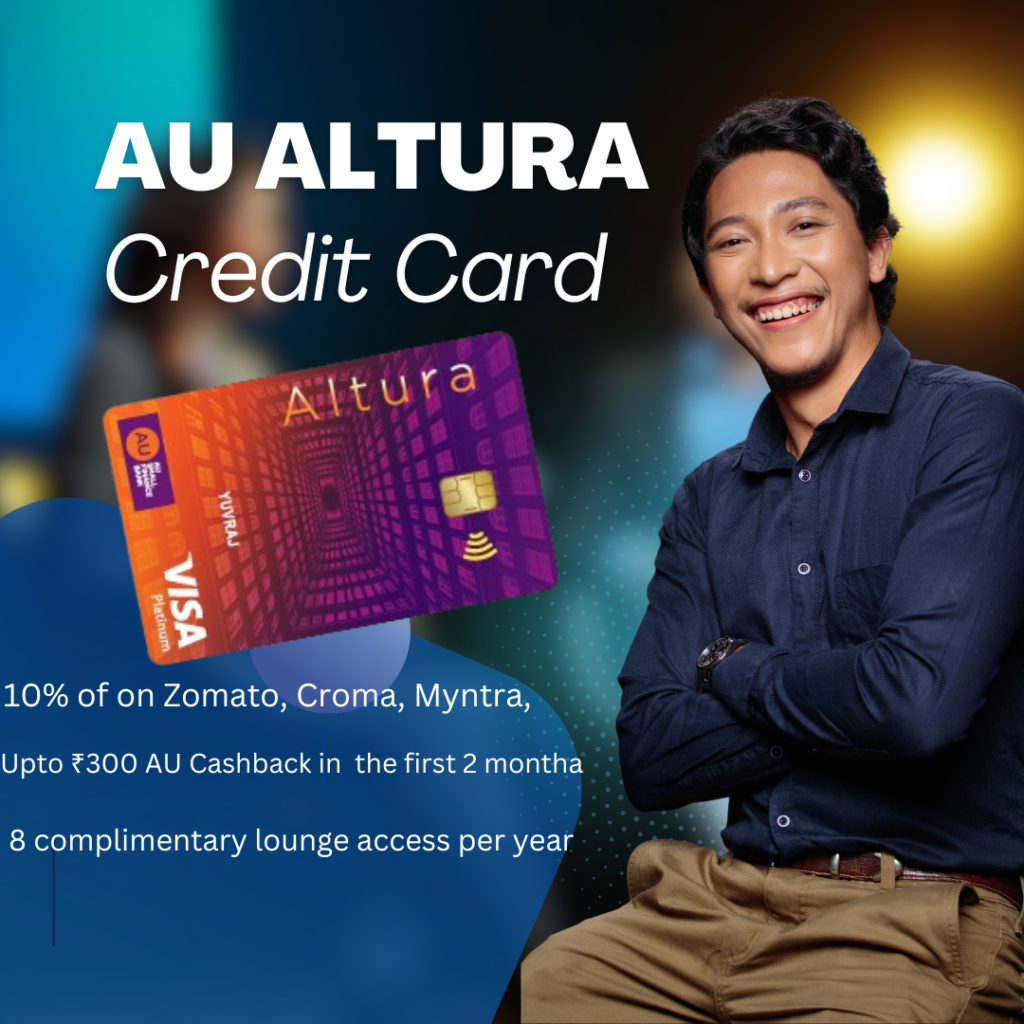

AU ALTURA CREDIT CARD

Features and Bennefit

Railway Lounges

4 ⇒ 2 complimentary lounge access per calendar quarter, using VISA Card at railway stations. For list of lounges and terms & conditions click hera

5 ⇒ Add-on cardholders can also enjoy these Railway lounge benefits within the mentioned complimentary number of visits. please click hera to view details

Fuel Surcharge Waiver

6 ⇒ 1% Fuel Surcharge Waiver for fuel transactions done between INR 400 and INR 5,000, across all fuel stations in the country (Maximum INR 100 per statement cycle)

Card Liability Cover

In an unfortunate event of loss of Credit Card, you carry zero liability on any fraudulent transactions made with card after reporting the loss to the bank.

• Also, you are protected against Card Counterfeit/Skimming and Online frauds. Please click here to view detailed terms and conditions.

Eligibility Criteria

Required Age: 21-60 years

Employment status: Salaried or Self-Employed

Income: Rs 25,000 per month (Salaried and Self-employed)

Customers need to have an Existing card (6 months old) with a minimum limit of Rs 30,000

No Delayed Payments in the last 12 months

Required Credit Score: 700+

FEES & LIST OF ALL CHARGES

Joining Fees: Rs 199 + Taxes

Annual Fees: Rs 199 + Taxes

Conditions for Annual Card Fee waiver

For 1st year fee waiver – Rs.10,000 retail spends done within 90 days of card set up

For 2nd year onwards fee waiver – Rs. 40,000 retail spends done in previous card anniversary year click here to view Key Fact Statement

DOCUMENTS NEEDED

Valid PAN Card

Aadhar Card – should be linked to Mobile (For EKYC)

address proof

Income Proof (if opted for Income surrogate)